TRANSACTION ARCHITECTS structuring and executing principal m&a

whether you’re ready to sell now or exploring your options for a partnership, we provide a discreet, straightforward process for business owners. Our goal is to structure mergers and acquisitions that preserve your legacy, maximize value, and create a smooth transition all while retaining employees, aligning with your objectives and timeline.

Connor von Schröder

Principal | Managing Partner | Chairman

"Old York Financial is a merchant house built on the 200-year merchant legacy of the von schröder family. We carry forward a multi-generational ancestral model of principal-led advisory and capital stewardship."

disclaimer: we act as principal-aligned M&A specialists, we may co-invest alongside buyers or owners, but do not function as a traditional broker-dealer.

M&A advisory + structuring for clients, and if we invest, we act as a principal.

Our M&A advisory is separate from capital raising. When Old York raises or accepts capital it does so as a principal through Old York Capital Partners.

Capital-raising, when it occurs, is via our private co-investment vehicle, not via public securities distribution.

when Old York participates financially in a private transaction, we do so as a principal co-investor through Old York Capital Partners; we do not act as a public securities intermediary.

transactions involving capital raising are structured in compliance with applicable securities laws.

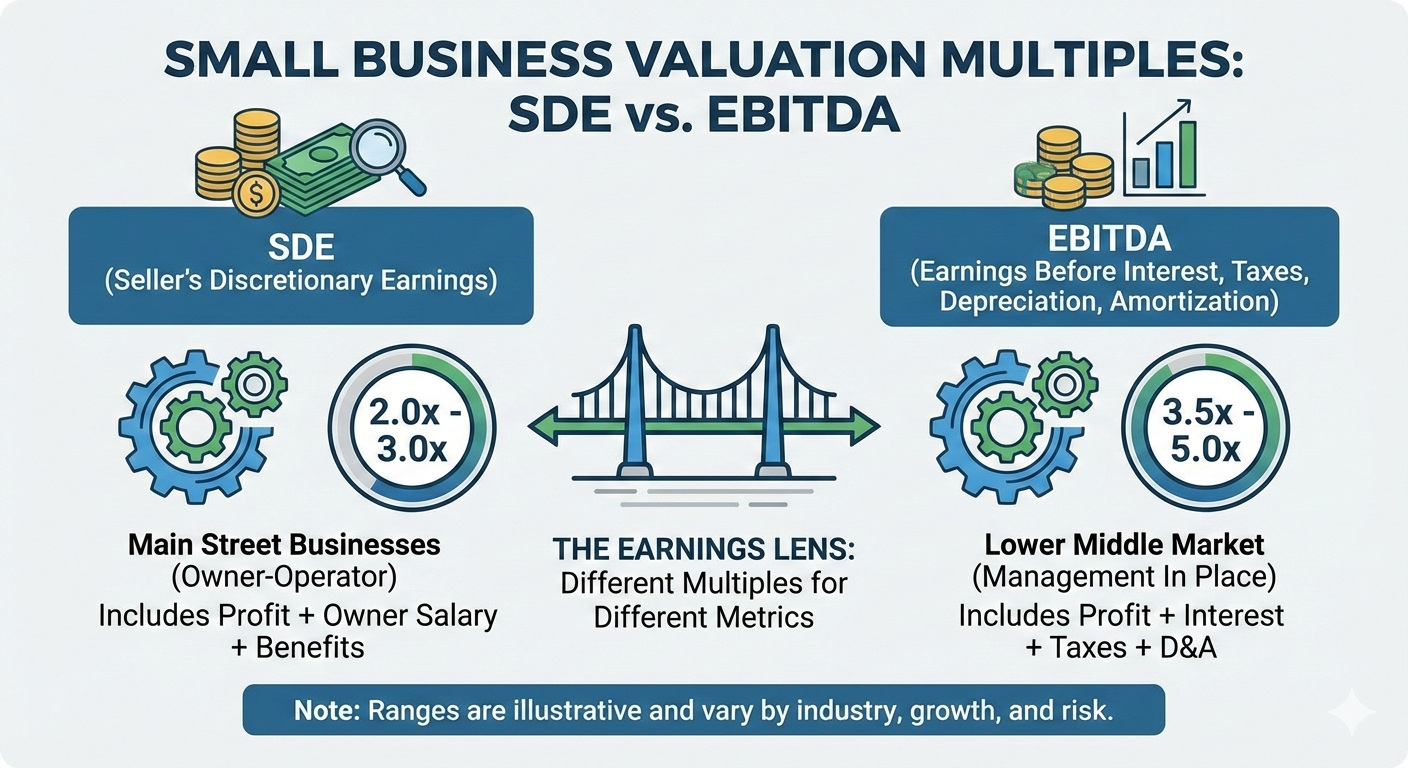

Most small-to-mid-market businesses fail to sell not because of poor operations, but because of poor 'deal-readiness.' At Old York Financial, we specialize in transforming opaque, family-run entities into transparent, bankable assets. Our Strategic Diagnostic process uncovers hidden value and de-risks the transaction for both the vendor and the acquirer.

we work alongside business brokers , explain how to sell your business & provide exit planning

start a confidential conversation about where you want to go today

Connor von Schröder

Principal | Managing Partner | Chairman

"Old York Financial is a merchant house built on the 200-year merchant legacy of the von schröder family. We carry forward a multi-generational ancestral model of principal-led advisory and capital stewardship."

info@oldyorkfinancial.com

picton, ontario

Monday–Friday

9:00am - 9:00pm